Yasmine Sharaf charged with fraud and left without car insurance

A Toronto mother used her severance pay to buy auto insurance but was left uninsured.

Yasmine Sharaf believed she had gotten a good deal on auto insurance.

The 48-year-old Toronto mother of three was in desperate need of a break; she had been laid off from her work as a market analyst last summer as a result of the COVID-19 pandemic, and her husband's salary had been reduced by 20%.

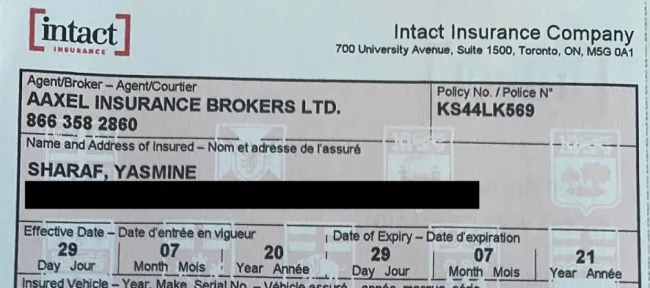

Therefore, when a local insurance broker informed her that she could obtain a decent deal on a policy for the family's two vehicles through Intact Insurance by paying $6,000 in advance to cover the year's premiums, she jumped at the opportunity.

"Everyone is looking for the best premium and lowest payment possible, because we all have a lot of bills to pay," she said.

She used the entirety of her severance package and supplemented it with funds from a line of credit to cover the bill.

However, Sharaf was taken aback four months later when she discovered Intact had cancelled her policy due to non-payment. She contacted Aaxel Insurance, the brokerage from which she bought the policy. She discovered that she had been a victim of fraud and that, despite the fact that the broker with whom she worked at Aaxel had sold her a legitimate policy, he has since been accused of pocketing some of the money she charged.

"They informed me that they are aware of a scam that occurred and that there are several victims," she said.

Daniel Conrado, 35, of Brampton, Ont., a former Aaxel employee, has been arrested and charged with defrauding members of the public. Peel Police report that they have received information from twenty victims alleging that Conrado stole their money and left them without adequate coverage. The accusations have not been established in court. Conrado's attorney refused to comment on how his client would plead.

However, in such a situation, what protection do Canadian consumers have? Sharaf contacted the CBC News Go Public team to inquire to see if assistance was available.

Though Sharaf was finally able to obtain new car insurance and reclaim her vehicle, the incident left her without a car for more than a month.

The ability to drive is important.

Sharaf explained in an email to CBC in February that she was desperate for the use of an insured car due to health issues.

At the age of 11, she was diagnosed with scoliosis. Her back reveals a deep scar that runs the length of her spine, and she is unable to walk for long periods of time without experiencing discomfort.

"Can you fathom what has happened to us?" she asked in her email. "We are stranded at home; my husband is unable to drive to work, and I am unable to get groceries because I have had ten spinal operations and am unable to bring anything."

She claims she contacted and emailed Aaxel Insurance, but the company directed her to contact Intact, which then directed her to contact the brokerage.

Desperate to drive, she attempted to purchase new insurance but was quoted high rates ranging from $10,000 to $12,000 a year. She was informed that Intact had classified her as a non-sufficient funds (NSF) payer. Individuals with a bad credit history pay a higher insurance premium.

"I've never had a non-sufficient funds (NSF) on my file," Sharaf said. "I'm still on top of my bills. I make all payments on time."

She claimed that she had no reason to suspect fraud with her initial payment because she sent funds via electronic transfer to Conrado's Aaxel work email. She stated that she considered the transaction's banking records to be a receipt because they contained the payment number, date, and recipient's email address.

Assistance from Intact.

Intact removed the credit question from Sharaf's record after being approached by Go Public. Sharaf was issued a checklist "that will help ensure that the fraud she witnessed does not adversely affect her auto insurance record or her ability to obtain auto insurance in the future," Intact spokeswoman Jennifer Beaudry said in a statement.

Additionally, the organization apologised to Sharaf.

"We investigated this situation and agree that it has taken an unreasonable amount of time to remedy this for our client," Beaudry told CBC News.

Sharaf has asked Aaxel to refund her for the $6,000 she transferred to Conrado. She said that the company's president was unhelpful.

"They do not want to be held responsible for the actions of their workers," she explained. "They have not responded to my emails."

Aaxel president Paul Mann told CBC News that as soon as he heard of Conrado's issues, he had the broker "walked out of the office" and sent to the province's brokerage regulatory body.

He mentioned that his firm never received any funds from Sharaf via e-transfer. "Daniel, I believe, deleted those emails," he wrote.

He verified receipt of her most recent phone calls and emails and claimed that the organization has always replied promptly.

Brokerage denies any responsibility.

Mann reported that his company, like all brokerages, offers "errors and omissions" insurance in addition to fidelity insurance to cover employee theft. At this point, he has made no argument.

"We cannot assume responsibility based on our lawyer's advice," he said, but added that Aaxel had "notified our insurer of the situation."

Fidelity insurance defends corporations from civil liability, although this argument has not yet been heard in court. If Aaxel refunds the money Sharaf charged to Conrado, this could be interpreted as the company admitting guilt and setting a precedent for other suspected victims to seek compensation.

Aaxel's Mann states in regards to his fidelity insurance that "policies have provisions that exclude insured [parties] from accepting any liability, or else coverage might be refused."

Consumers should have a sense of'security.'

Consumers should feel "secure," according to Patrick Ballantyne, CEO of the Registered Insurance Brokers of Ontario (RIBO). He stated that his organization's mission is to protect customers in insurance purchases by licensing brokers, establishing a complaint mechanism, and disciplining violators.

"The fidelity bond provision is intended to safeguard them in the extremely unlikely event that anything like this occurs," he said. However, he admitted that the process is lengthy.

He characterizes the situation at Aaxel as unique.

"These are the acts of a single rogue entity," he explained. "Every day, hundreds, if not thousands, of insurance transactions take place in the province. And the vast majority of them are perfectly acceptable."

Ballantyne reports that RIBO receives an average of 100 inquiries each month through its online portal, with approximately 10% requiring further investigation.

However, the regulator lacks the authority to compel the return of misappropriated funds.

"We are not here to recover their money," Ballantyne stated. "We're designed to ensure that the people with whom they communicate are handled fairly under our rules and procedures."

He stated that brokers will face reprimands and have their licenses revoked if necessary.

Exercise due diligence.

Sharaf has no intention of waiting years to earn her money back. She has filed a small claims lawsuit against Aaxel Insurance.

"I'm bringing them to court so they realize that a business is accountable for who they recruit and what happens as a result of these employees' decisions," she said.

She now has fairly priced insurance as a result of the letter from Intact. And she has found work as an account manager with an information technology company after eight months of unemployment.

She cautions Canadians to carefully vet any broker with whom they do business.

"The most critical thing is that this can never happen to another human," she said.